The Government has announced a reduction in Stamp Duty Stamp Duty Land Tax which will apply to residential property sales in England and Northern Ireland. Under the new measures, no tax needs to be paid on properties up to the value of £250,000.

What has changed?

The raising of the Stamp Duty threshold now means that all homebuyers are exempt from Stamp Duty on the first £250,000 of the purchase price. The previous threshold was £125,000. Properties valued above £250,000 will still have a Stamp Duty charge of 5% on the portion between £250,001 and £925,000.

For first-time buyers, the Stamp Duty exemption threshold has increased to the first £425,000 of the purchase price. A 5% charge applies to the rest of their purchase price, up to £625,000.

What does this mean for your homebuying costs?

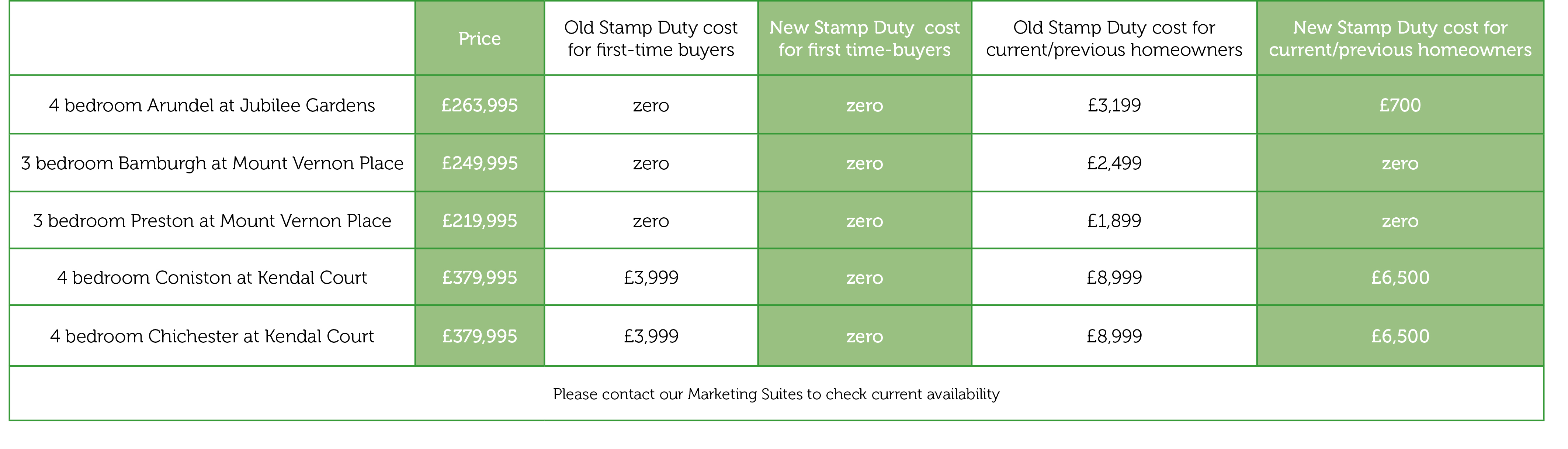

This means you can make substantial savings on a new home at Orion Homes’ current developments, including Jubilee Gardens in Gilberdyke, Mount Vernon Place in Barnsley and Kendal Court in Ossett. If you currently own a home or have owned a home in the past, you could save up to £2,499 on Stamp Duty. If you’re a first-time buyer, you could save £3,999 on Stamp Duty.

Contact Orion Homes to find out more

The Sales Advisors at Orion Homes’ Marketing Suites are available to answer any questions you have about the latest Stamp Duty changes and how they might affect you. Please note that there is no on-site Marketing Suite at our Kendal Court development, but you can contact the Sales Advisor on 07939555806. You can also contact our head office on 01924 831030 or sales@orionhomes.co.uk for advice and guidance.

Alternatively, please send an enquiry via our Contact Page